THE PILOT OF AN EMPLOYMENT

INJURY SCHEME FOR BANGLADESH’S RMG SECTOR

LACK OF COMPREHENSIVE INJURY PROTECTION

Bangladesh can look back on one of the most remarkable development achievements of the last 50 years. Established in 1971 as one of the poorest countries in the world, Bangladesh attained middle-income country status in 2015 and is on track to graduate from the UN list of least developed countries (LDCs) in 2026.

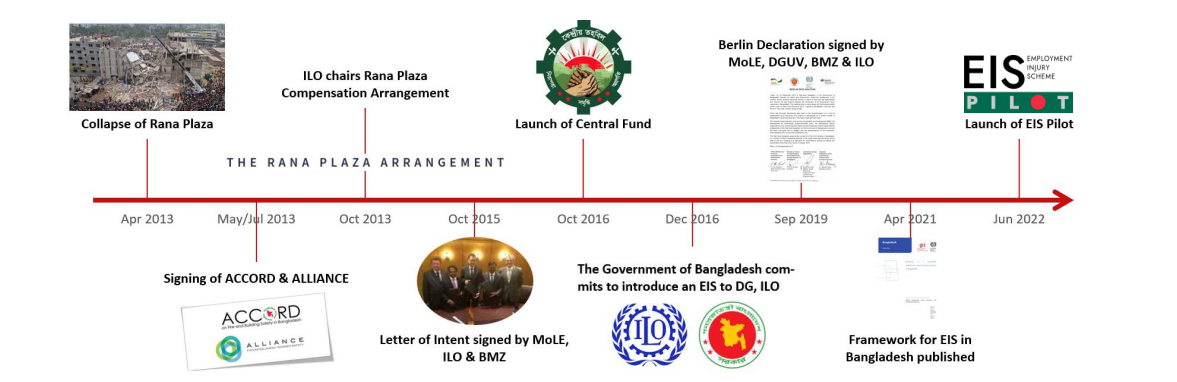

In accordance with these impressive accomplishments, the last decade has witness significant progress on the way towards decent and safe working conditions in the ready-made garment(RMG) industry of Bangladesh. In 2013 and 2018, labour legislation reforms were implemented, and the minimum wage was significantly raised. Moreover, statutory compensation payments for occupational accidents resulting in death and permanent disability were increased and a new Central Fund as central governmental agency for the administration of compensation benefits was created. In order to guarantee enough funding for compensations, the Central Fund’s benefit payments are financed by a levy on the exports of direct exporters of the RMG sector.

However, a comprehensive employment injury scheme (EIS) that effectively protects workers against falling into poverty as a result of workplace accidents and occupational diseases does still not exist. The Central Fund’s compensation benefits are not in accordance with international standards as defined in the ILO Employment Injury Benefits Convention (No. 121, 1964/1980) and, thus, cannot prevent impoverishment of accident victims and their families.

ILO Convention No. 121 – Employment Injury Benefits Convention, 1964/1980

C. 121 sets the international standard for the minimum benefits for employment injury compensation. It requires earnings-related, periodical (monthly) payments to victims of employment injuries and occupational diseases. In case of disability, the payments amount to at least 60% of the former wage multiplied by the degree of disability. In case of death, dependents (e.g. spouse, underaged children) receive payements in the extent of at least 50 % of the former wage of the victim.

THE EIS PILOT IN THE RMG SECTOR

The responsible stakeholders are well aware of the problem. As a decisive step towards adequate protection, the Government of Bangladesh, the ILO and the German Social Accident Insurance (DGUV) agreed in September 2019 to initiate a pilot of an EIS for the RMG sector. It was agreed that the ILO and GIZ would work in close cooperation on establishing the administrative processes and support the implementation as well as the transition to a permanent EIS after 3–5 years.

On 18 February 2021, the Government of Bangladesh established a tripartite committee tasked to piloting an employment injury insurance scheme in Bangladesh. The committee’s working group met at the end of 2021 to discuss the details and main elements of the Pilot, which were finally endorsed by national stakeholders in early 2022. Accordingly, the EIS Pilot is conceptualised as a transformative approach,

leading to the introduction of a permanent statuatory EIS. In March 2022, the Government of Bangladesh notified that the Central Fund will administer the Pilot and open a separate fund account as well as establish a governance system. The EIS Pilot was officially launched on 21 June 2022.

The Pilot has two components:

1.data gathering and capacity-building component on occupational accidents, diseases and rehabilitation, based on a sample of representative factories

Research is carried out on the average medical care costs for workers in case an injury occurs. This will help identify the resources necessary to ensure that the obligation to provide medical care enshrined in the Bangladesh Labour Act (BLA) is effectively met.

The research extends to the process adhered to and the benefits provided in case of temporary incapacity. This will allow to demonstrate, based on reliable evidence, the viability, feasibility and cost efficiency of a comprehensive EIS in Bangladesh and ensure the affordability of employers’ contributions by testing the impact of a sharing-of-responsibility approach. Approximately 150 factories will be participating in this component, covering at least 150,000 workers

2.risk-sharing component for long-term benefits: payment of ILO-compliant compensations in case of permanent disability / death for the entire export-oriented RMG sector

Under component 2, the Pilot provides income replacements for the permanently disabled and the dependents of deceased workers, covering all factories contributing to the export-oriented RMG sector. This takes the form of periodical payments / pensions as top-ups to the lump-sum payments of the Central Fund, rendering the level of benefits compatible with ILO Convention No. 121. These payments are financed by international brands.

Sustainable Development Goal 1.3

Implement nationally appropriate social protection systems and measures for all, including floors, and by 2030 achieve substantial coverage of the poor and the vulnerable.

The Pilot thus contributes to a better understanding of how the future system should work to ensure that workers are compensated adequately and expeditiously regardless of an accident’s magnitude.

The Pilot’s tripartite governance mechanism strengthens national governance structures and ownership and provides a clear exit strategy after 3–5 years.

The social insurance approach effectively mitigates individual risks, ensuring the long-term sustainability of the achievement.

By implementing the EIS Pilot, the Ministry of Labour and Employment ensures amounts of benefits in line with international standards. Thereby, decent living conditions for workplace accident victims and their families are safeguarded. This directly contributes to the achievement of SDG 1.3.

Background on EIS

In many countries, a scheme for the protection and compensation of work-related injuries constitutes the oldest branch of social security. Most countries adopted the modality of an employment injury insurance (EII) for the compensation of work-related injuries and diseases. In the last hundred years, EII has proven to be the most effective and efficient form of employment injury protection.

No-fault Principle

The concept of EII implies that employers and workers agree to a trade-off: workers are compensated for damages resulting from employment injuries without having to prove the employer’s negligence in court; in return, workers waive their right to sue the employer in the event of an accident at work; the employers’ liability is thereby limited to the premium they pay to the insurance scheme, thus eliminating any risk of excessive financial burden resulting from lawsuits. This leads to adequate and speedy compensation without court cases. An efficient no-fault and risk-sharing EIS based on the principles and standards of relevant international labour standards (particularly C. 121 and R. 202) lowers production costs and enables harmonious work relations. It is a win-win that makes both employers and workers better off.

Collective Sharing / Risk Pooling of Costs by Employers

The total cost of the compensation system is shared by all employers. Every employer of the scheme contributes to a common fund in advance. Compensations are guaranteed regardless of employers’ behavior or financial solvency, even for cases of work-related diseases

Neutral Governance

The right to benefits is established outside the contractual relationship between worker and employer and through a public or private carrier. There are no direct disputes or complaints, leading to systematic, objective, professional and speedy decisions.